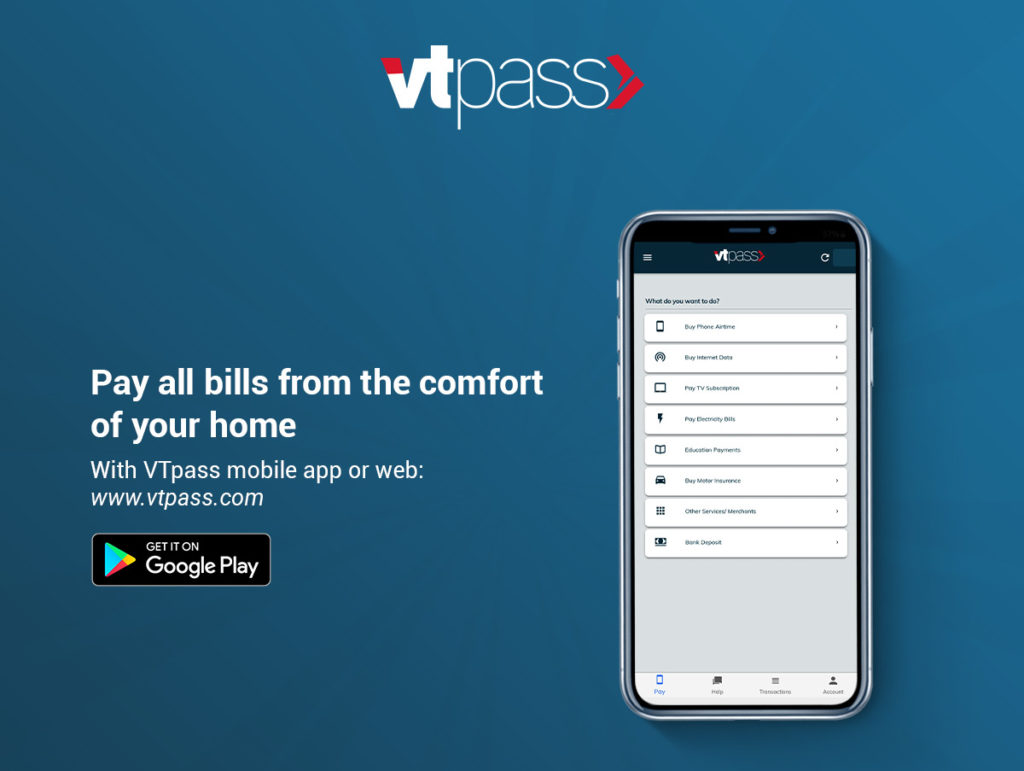

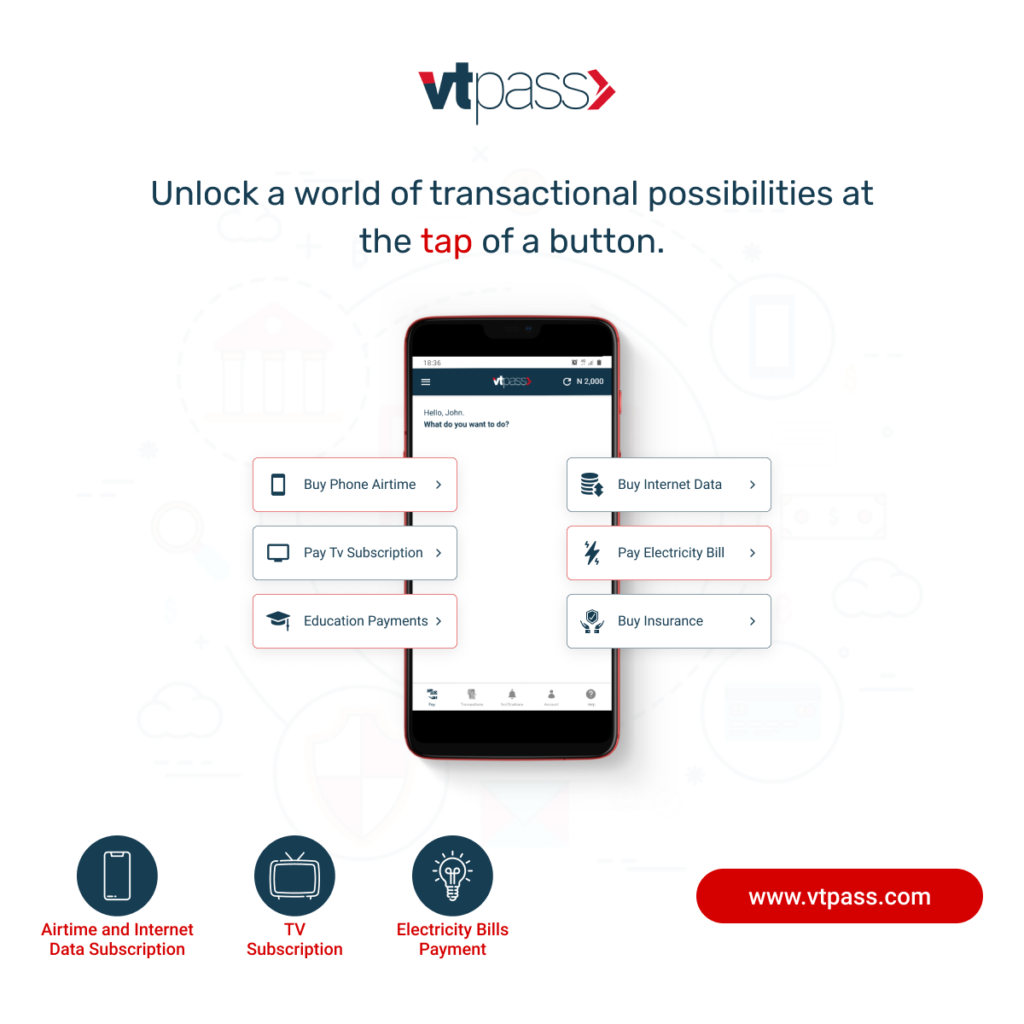

The Vtpass brand prides itself on providing exceptional customer support and representation. In the event that you need assistance from a Vtpass Support Representative, you can be assured that you will get it immediately. Vtpass has one of the most active support teams and the team is always ready to answer all the questions you may have. Vtpass customer support is available to help you across all online and offline touchpoints; this article highlights all official platforms available to reach out to the Vtpass team. They are always willing to listen to feedback and take the extra mile to ensure that our customers are satisfied with the services they purchase.

Nonetheless, we have compiled an updated list of questions you might have about Vtpass’ services before reaching out to the support team. Click here to check it out, you’d be surprised that you may find answers to your questions within a few seconds. We encourage you to check out this article and reach out to us using the method that is most convenient for you if you have specific questions. You can always count on us for assistance. 🤗

Reach out to Vtpass on Instagram

Live chat on the Vtpass Website

Reach Out to Vtpass on Instagram

How much do you love Instagram? It’s the same for us. 😊 Our Instagram content aims to educate and entertain our customers at the same time, so we put effort into it every day. We post carousels, reels, regular posts, videos and update our stories with relevant content. You will definitely love it!

Our team is available around the clock to help resolve issues and complaints.. Simply send us a DM on Instagram. Our official handle is @vtpass. You will enjoy scrolling through the feed and moving towards your financial goals. Our team is always ready to help, so don’t hesitate to reach out – you’ll get a response quickly! Direct message us on Instagram @vtpass and start achieving your financial goals today.

Contact us via Twitter

On Twitter, we share relevant information about our products, give updates and even express our thoughts on relevant trends from time to time. And yes, our support team responds to all direct messages sent on Twitter within record time. This helps us build a strong connection with our customers, create an engaging community and ensure optimal customer satisfaction. By staying active on Twitter, we’re able to keep our customers informed about our products, services, and any changes that may be taking place. We also encourage conversations that help us learn more about our customers and their needs. This has enabled us to build trust and establish ourselves as a reliable source of information.

Our official Twitter handle is @vtpass. Click here to send us a message, follow and turn on notifications to ensure you do not miss out on upcoming updates and fun conversations with us. Additionally, like and share our posts to spread the word and help us grow our community!

Follow Vtpass on LinkedIn

We have established a professional backdrop on LinkedIn.

We share fabulous stories about our work culture on LinkedIn. You should follow us to confirm that we are not a regular company. Our stories and articles are written to show how our company is different from other companies in terms of values, transparency, and collaboration. We believe that if you follow us, you will get an insight into the unique culture we have created. 😉

On LinkedIn, you can’t send messages as the platform doesn’t provide an option to message a business. But you can hang around, and understand how we operate as a business.

Click here to check us out on Linkedin

Reach out to us on Facebook

Our commitment to you transcends borders and boundaries. We want you to find us easily, so we made it to Facebook as well. You’ll find helpful information on our Facebook page and also reach out to our support team ready to attend to your enquiries.

Visit @Vtpass on Facebook or click here to find us on Facebook right away.

Call or send a mail to Vtpass

Have enquires? Shoot us a mail at support@vtpass.com. Your complaint or enquiries will be resolved immediately, and a feedback promptly. And if you prefer to reach out to us via phone call. You can reach us on +2349087482377.

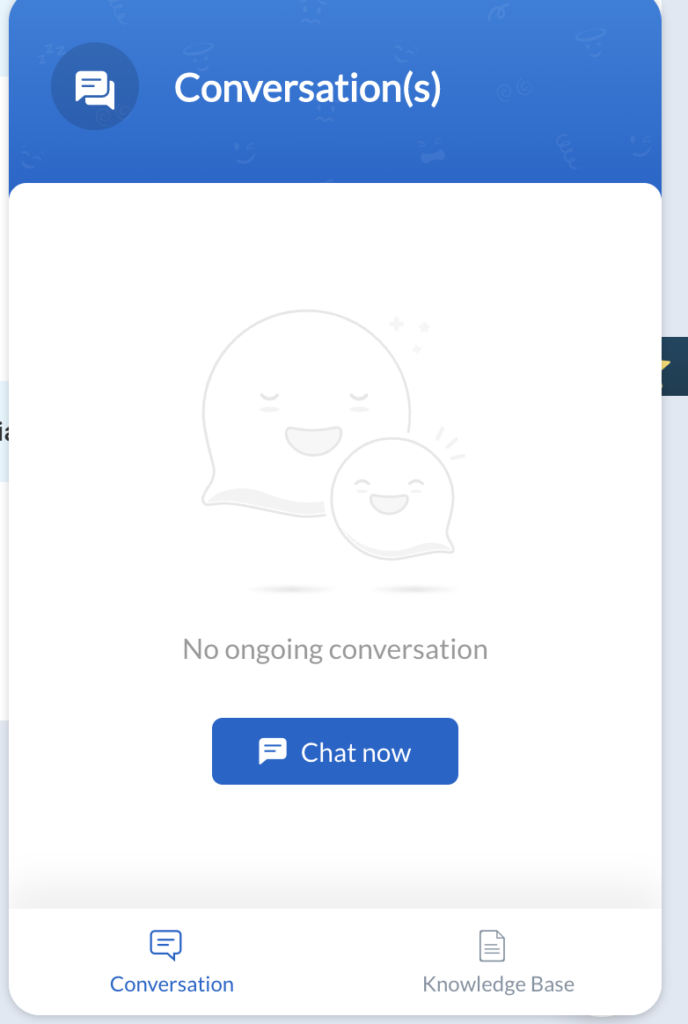

Live chat on the Vtpass website

If you log on to the Vtpass website, locate message icon at the bottom left of your screen. Click on that little icon, and a conversation box will pop up immediately.

Here, you have a chance to reach out to our customer support representative who are always online 24/7 to attend to you. Alternatively, you can check out the knowledge base where you can learn some reasons why you are having that issue.

CAUTION:

You may receive a call from a Vtpass customer service representative regarding a transaction. In cases such as this, we urge you to properly question the agents in order to confirm that they are indeed Vtpass representatives. Once again, your satisfaction is our utmost priority and we will never fail in ensuring that you get the highest quality customer service representation.