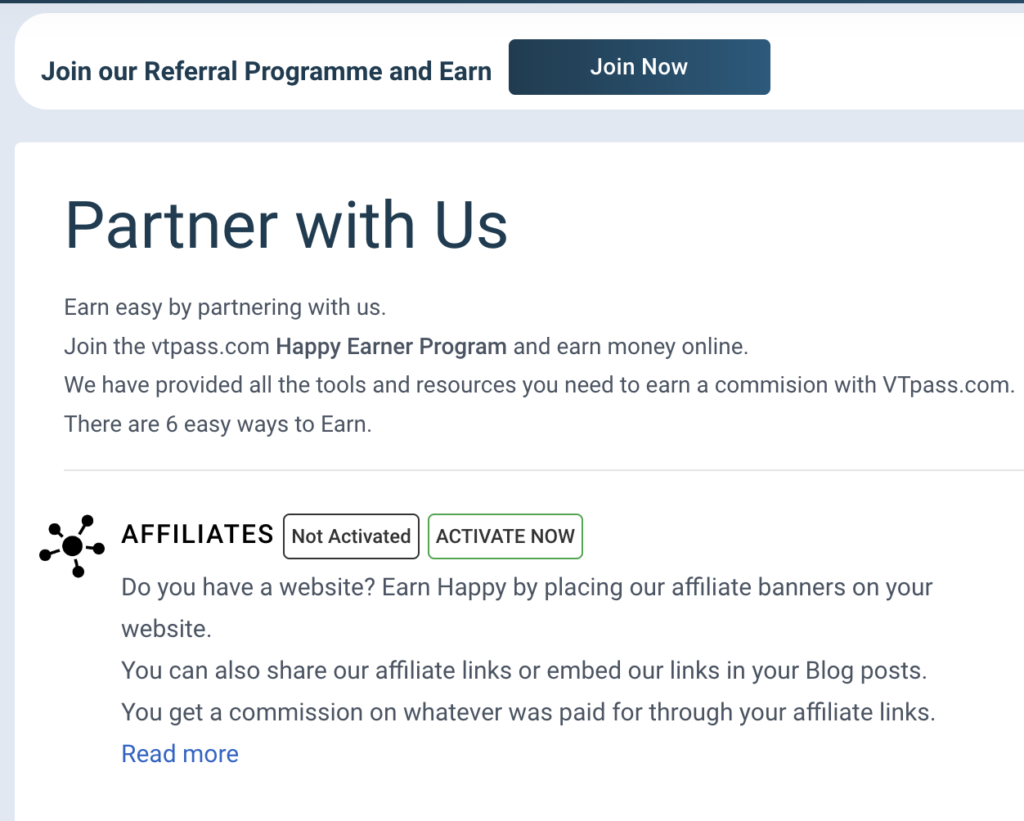

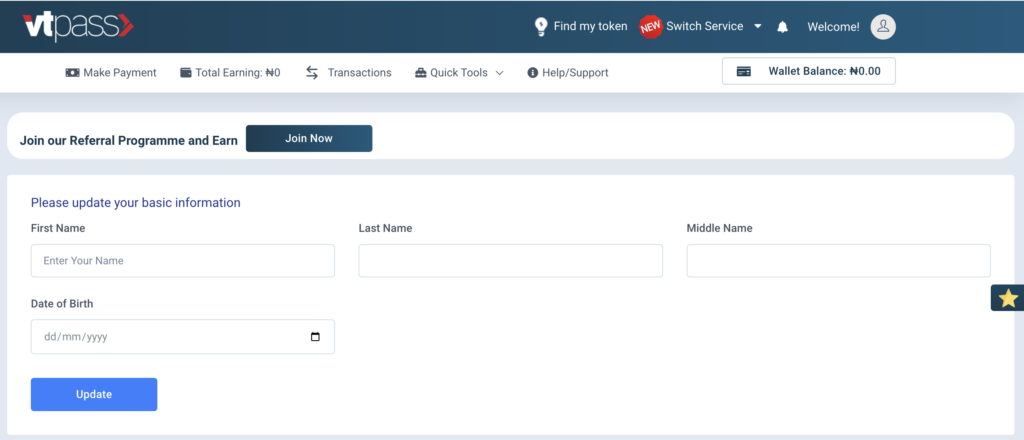

You know the drill; make sure you have a registered account with VTpass to enjoy the full benefits of Showmax. Now, let’s get into it. The series on Showmax “Flawsome” has had me on a chokehold as the drama, secrets, and tension continue to rise with each episode. Ready for a swirl ride? come with me as we explore the plot. If you have not seen it, make sure you subscribe to Showmax on VTpass

The Reasons “Flawsome” Belongs on Your Binge List:

Flawsome revolves around the lives of four women: Ifeyinwa (Bisola Aiyeola), Ramat (Ini Dima-Okojie), Ivie (Sharon Ooja), and Dolapo (Enado Odigie). showing their personal and professional lives, bound by their flaws, and yet the unbreakable ties they share as friends.

Ifeyinwa has been preparing all her life to become the CEO of her father’s company, but it slips away. Ramat has a “perfect” marriage, but her reality isn’t as promising as it seems. Ivie abandoned her profession to pursue a career in fashion design with the hopes of living the big city girl’s life.However, it all unfolds into a masterpiece. I tell you, it is a lot.

Beyond the Laughs: While the show is undeniably funny, it also tackles deeper themes of self-acceptance, friendship, and finding your place in the world. Prepare to be touched and inspired as these characters embrace their flaws and chase their dreams.

Using VTpass to Unlock the World of Showmax:

In order to watch the “Flawsome” phenomenon, a Showmax subscription is required. But fear not, lovers of drama! Showmax subscriptions are simple to set up with VTpass:

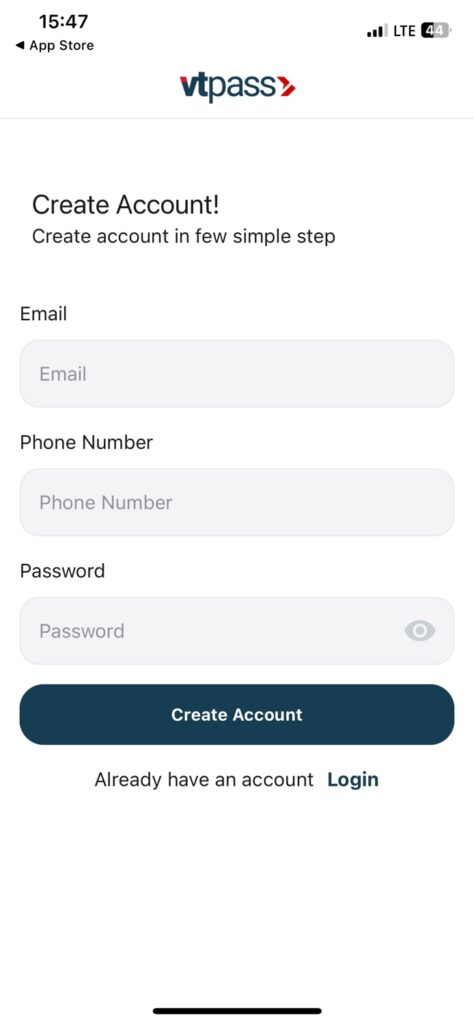

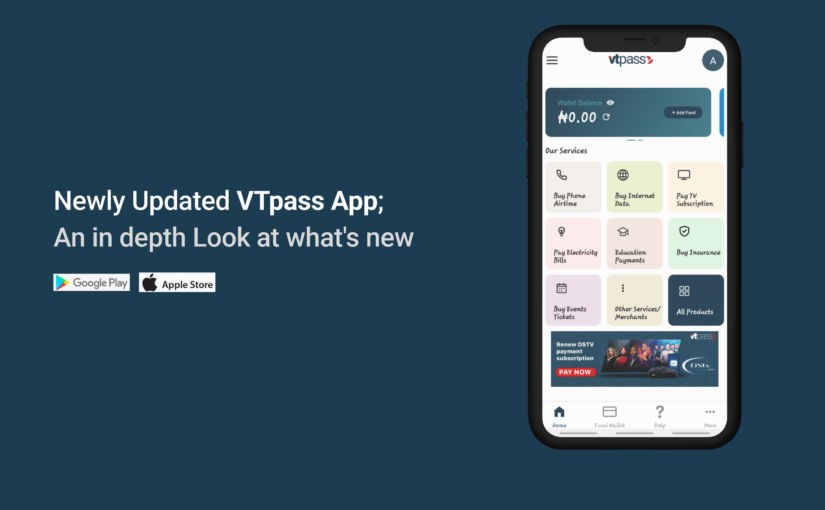

Simple Sign-Up: Forget about tiresome registration procedures. You can sign up for Showmax straight through VTpass’s user-friendly website or app. It’s an easy and quick method to begin watching your preferred programs online.

Flexible Payment Options: Debit cards, credit cards, and bank transfers are just a few of the safe payment options that we provide. Select the one that best fits your spending capacity.

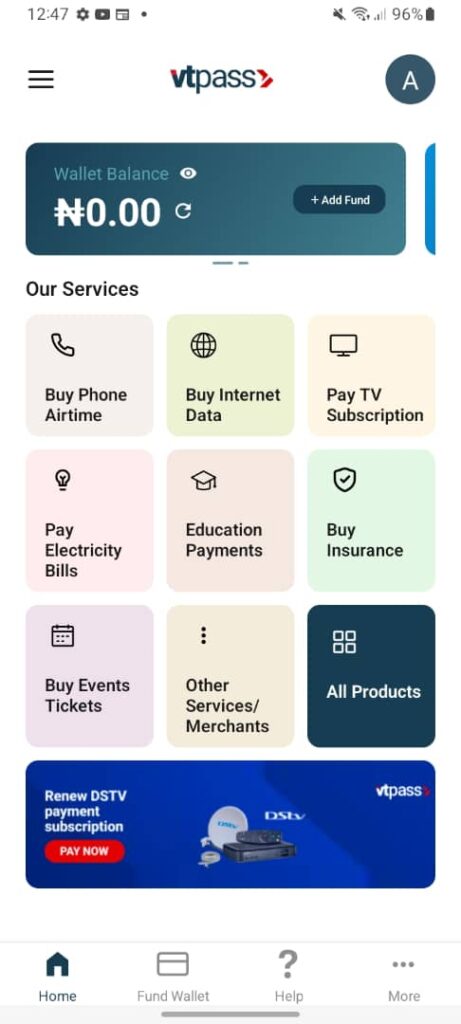

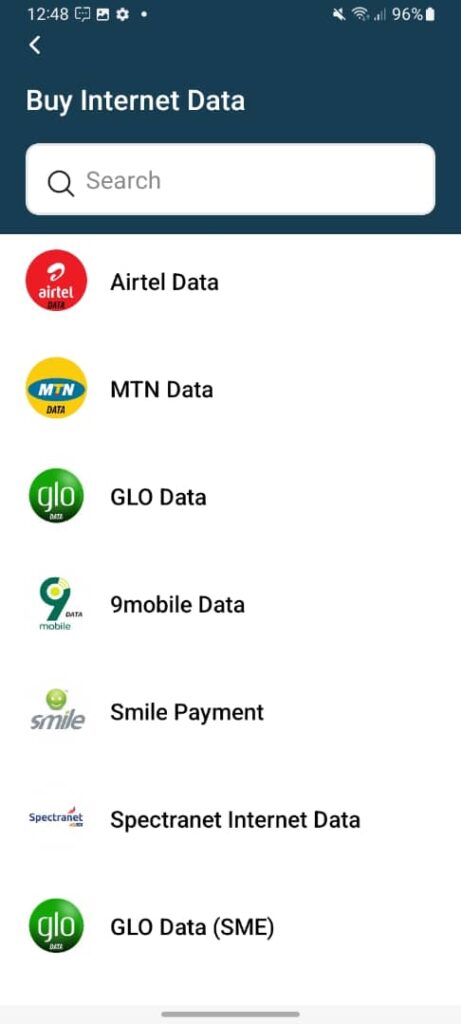

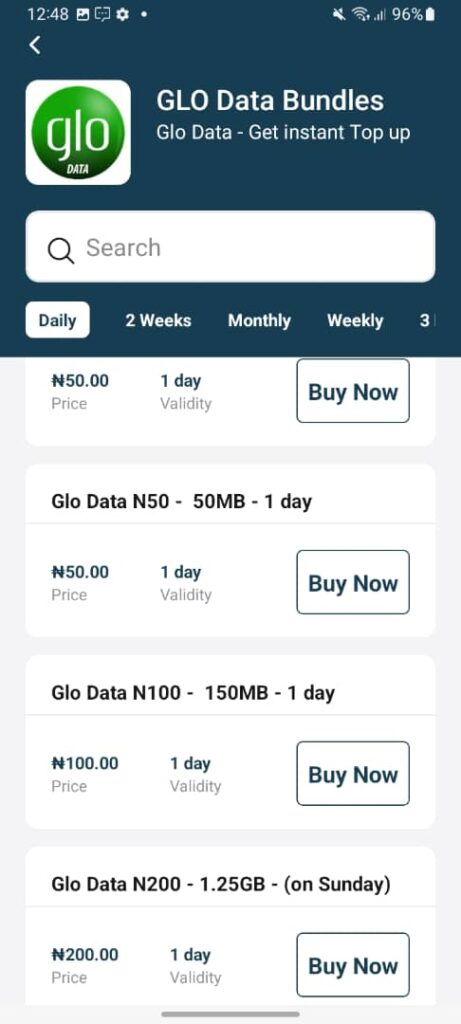

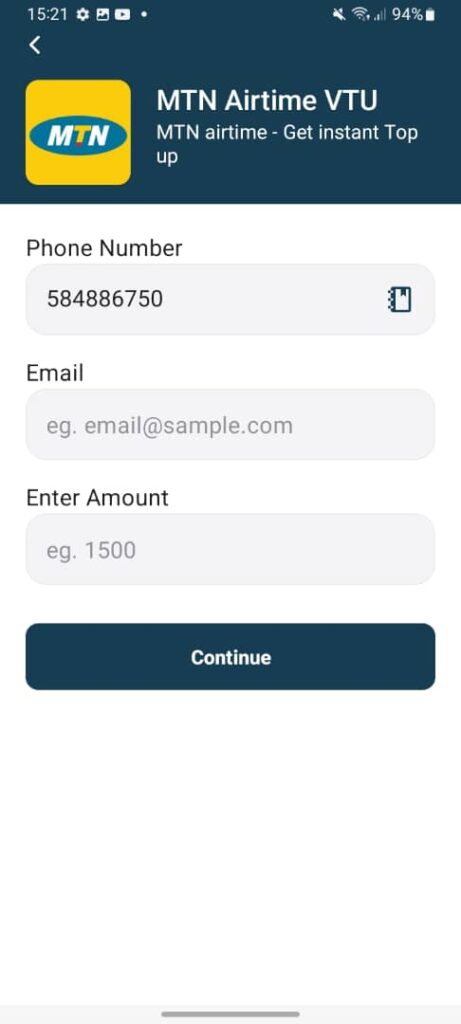

All-in-One Platform: Manage your Showmax subscription alongside other essential services like data, airtime purchases, and even your electricity bills—all within the familiar VTpass platform.

Beyond Merely “Flawsome”

“Flawsome” is a guaranteed smash, but Showmax has an extensive archive of stuff that is worth bingeing. Lastly, navigate to the VTpass app or website, sign up for a Showmax subscription, and be ready to explore the charming world of “Flawsome.” Recall that accepting your imperfections makes you laugh out loud!