In an increasingly digital world, online transactions have become an integral part of our daily lives. From paying bills to purchasing goods and services, the convenience of online payments cannot be overstated. However, with the rise in online transactions, the need for robust security measures has also grown. This blog post explores how VTpass, a leading online payment platform, prioritises online payment security to ensure that your transactions are safe and protected.

Understanding Online Payment Security

Online payment security refers to the measures and protocols put in place to safeguard the confidentiality and integrity of your financial information during online transactions. It is crucial because, without proper security, your sensitive data can be vulnerable to theft and fraud.

VTpass’s Commitment to Payment Security

- Secure Payment Gateway: VTpass employs a secure payment gateway that encrypts your financial data, making it virtually impossible for unauthorized parties to access or intercept it during transmission.

- Data Protection: VTpass follows strict data protection guidelines to ensure that your personal and financial information is stored securely. They have implemented robust data protection measures in compliance with industry standards.

- Two-Factor Authentication (2FA): VTpass offers an extra layer of security through 2FA. This means that in addition to your password, you’ll need to provide a one-time code sent to your registered mobile number or email for certain transactions, adding an additional layer of protection.

- Regular Security Audits: VTpass conducts regular security audits and assessments to identify and address vulnerabilities proactively. This ongoing commitment to security ensures that the platform stays ahead of emerging threats.

- User Education: VTpass actively educates its users about online security best practices, such as creating strong passwords, not sharing sensitive information, and recognizing phishing attempts. They also provide tips on keeping your account secure.

- Fraud Detection and Prevention: VTpass employs advanced fraud detection and prevention mechanisms to identify and block suspicious activities in real-time, protecting users from potential fraudulent transactions.

- Secure Third-Party Partnerships: When working with third-party service providers and partners, VTpass ensures that these partners also maintain high-security standards, minimizing the risk associated with shared data.

- Customer Support: VTpass offers a responsive and helpful customer support team that is available to assist with any security-related concerns or inquiries promptly.

payment security

User Testimonials: Trusting VTpass with Your Payments

Here are some user testimonials that reflect the trust users have in VTpass’s commitment to online payment security:

- Sarah: “I use VTpass for all my utility bill payments because I know my financial information is secure. The two-factor authentication gives me peace of mind.”

- James: “VTpass’s customer support helped me resolve a potential security issue quickly. Their proactive approach to security impressed me.”

- Lisa: “I appreciate how VTpass keeps me informed about online security best practices. It shows they genuinely care about their users.”

Conclusion

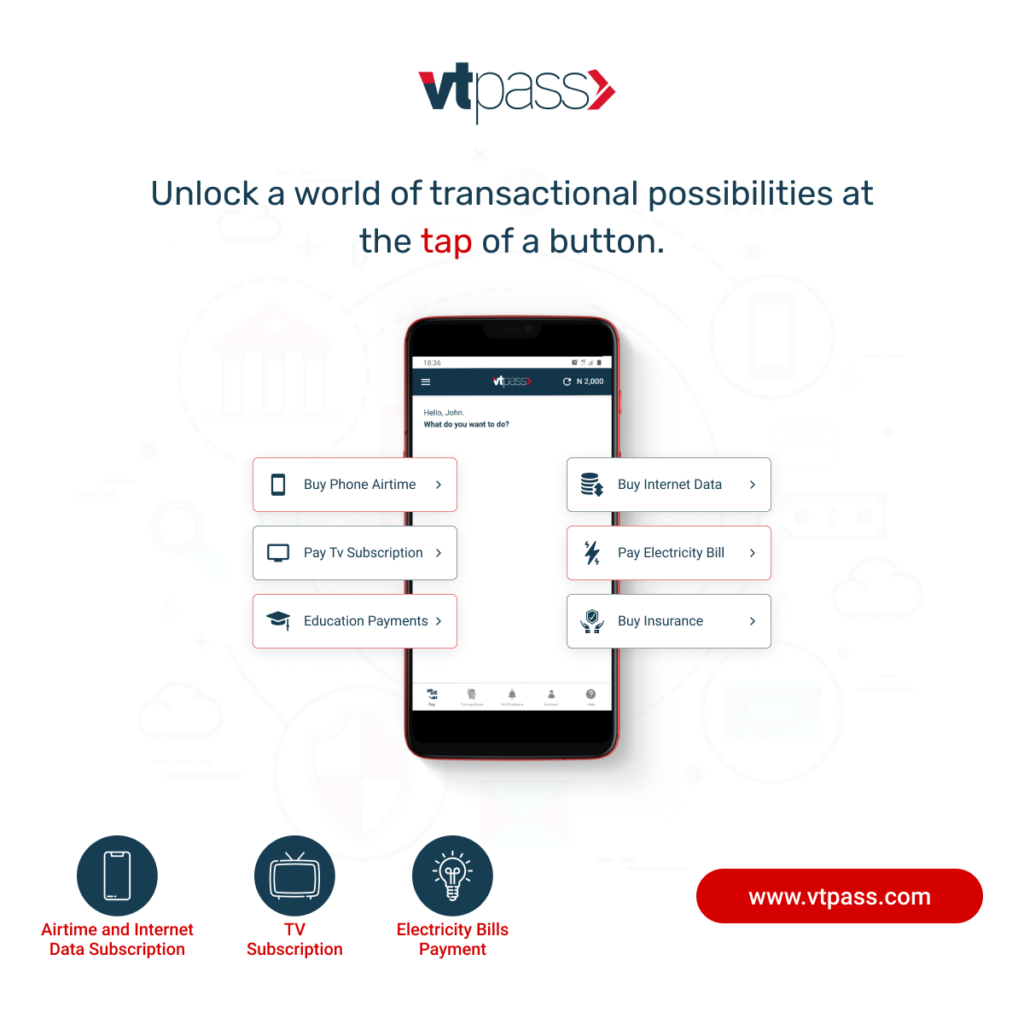

In an age where online payment security is paramount, VTpass has proven itself as a reliable for financial transactions. Our commitment to security, tensures that your sensitive information remains protected. You can confidently use VTpass for all your online payment needs, knowing that your transactions are secured with the highest level of protection. Stay safe and secure while making your payments with VTpass!

Bills payment with vtpass.com is superfast, easy and very convenient. In addition, you get 24/7 access to our support team to help you through any glitch you might have. Why don’t you try us today?