Do you ever feel as if your business is stuck on a treadmill? Despite your best efforts, the scenery is staying the same. Customer engagement is flat, sales are stagnating, and it appears that your once-ambitious vision is vanishing.

Be not alarmed if this sounds like you! It is a typical occurrence for companies of all kinds. However, it also indicates that you may require a growth strategy, which is a plan of action to advance your company and reach your major objectives.

Here are three indicators that your business needs a growth strategy:

Stagnant Sales: Do your monthly business sales figures seem to be stagnating? This can mean that your present consumer base or marketing strategy has hit its limit. You may find new markets for your products, improve your marketing strategies, and boost sales with the aid of a growth strategy.

Ineffective Operations: Has overseeing your daily operations become more difficult and time-consuming? This may hinder your development and make you feel overburdened. A well-defined growth strategy will frequently entail streamlining processes, integrating new technologies (such as VTpass!), and optimizing workflows to free up critical time and resources.

Absence of Innovation: Do you feel unmotivated and confined to your comfort zone? Innovation is essential to sustained business growth. Whether it’s creating new goods or services, investigating uncharted territory, or adopting novel marketing techniques, a growth plan can assist you in identifying opportunities for innovation.

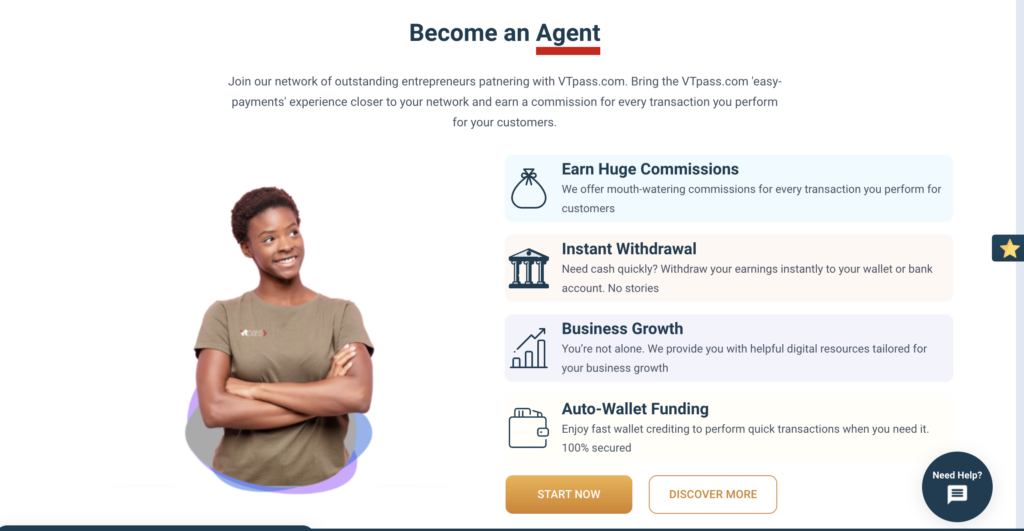

So how can VTpass support the expansion of your company?

Here are a handful of methods:

Enhanced Inventory & Sales Efficiency: VTpass streamlines inventory tracking, streamlines sales transactions, and offers insightful data. This allows you to concentrate on projects related to growth.

Enhanced Customer Engagement: VTpass enables you to provide a consistent customer experience by offering a variety of payment choices, loyalty programs, and speedier checkouts. This promotes repeat business and increases client happiness.

Data-Driven Decision Making: VTpass offers insightful customer and sales data. This gives you the ability to decide on marketing tactics, product lines, and the general course of your company with knowledge.

Make your business growth count with VTpass and expand to new heights. Sign up with VTpass today.