In the fast-paced world of today, time is of the essence, you cannot afford to miss a due date. We’re constantly juggling work, family, and social commitments, leaving us with very little time for mundane tasks. Paying bills and managing due dates can be one such tedious chore that often slips through the cracks, resulting in late fees, penalties, and unnecessary stress. But fear not! There’s a solution that can help you stay on top of your bills and never miss a due date again: Vtpass.

We’ve all been there – the frantic rush to pay bills before the due date. Whether it’s your electricity, water, cable TV, internet, or mobile phone bill, managing these expenses can be daunting. Life is busy, and remembering due dates for multiple bills is a struggle. This is where Vtpass comes to the rescue.

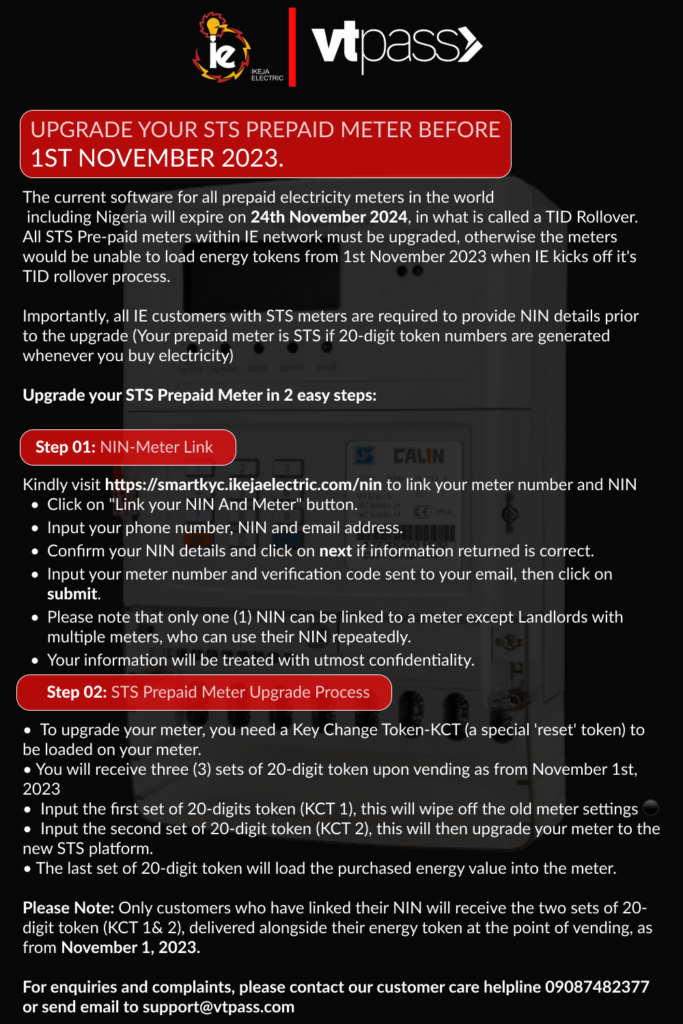

Vtpass is a revolutionary online platform that simplifies paying bills and purchasing airtime, data, and other services. With Vtpass, you can access a wide range of services, all in one place.

How Vtpass Works to help you avoid missing a due date

Vtpass operates on a simple yet highly efficient model. Here’s how it works:

1. Create an Account: To get started with Vtpass, you need to create an account on their platform. This is a one-time process and takes just a few minutes.

2. Select Your Service: Once your account is set up, you can start using Vtpass for a wide range of services. You can pay bills, purchase airtime, buy data bundles, renew your cable TV subscription, and more.

3. Enter Details: For bill payments, you need to enter the necessary details, such as your meter number, decoder iuc or other required information. Vtpass makes it easy by providing clear instructions for each biller.

4. Review and Confirm: After entering the details, you can review your transaction to ensure everything is correct. Once you’re satisfied, confirm the payment.

5. Make Payment: Vtpass offers multiple payment options, including debit cards, internet banking, and even pay with the funds in your Vtpass wallet.

6. Receive Confirmation: After a successful payment, you will receive a confirmation message and a payment receipt for your records.

The Advantages of Using Vtpass

Using Vtpass to manage your bills and payments offers several advantages:

1. Convenience

Vtpass simplifies the entire process of bill payments. You can complete your transactions from the comfort of your home or office, without the need to visit multiple offices or stand in long queues. This convenience saves you valuable time and effort.

2. Accessibility

Vtpass is available 24/7, which means you can pay your bills and purchase services at any time that suits you. Whether it’s early in the morning or late at night, Vtpass is always there for you.

3. Variety of services

Vtpass offers a wide range of services, including electricity, water, cable TV, internet, mobile recharge, and even educational services. This variety ensures that you can handle all your financial and service-related transactions in one place.

4. Timely Reminders:

One of the key features of Vtpass is the option to set up reminders for your bill due dates. You’ll receive notifications well in advance, helping you stay organized and avoid late payments.

5. Secure Payments

Vtpass employs state-of-the-art security measures to protect your financial information and transactions. You can trust that your payments are secure and your data is protected.

6. Instant Transactions

No more waiting for hours or days for your payments to reflect. Vtpass ensures that your transactions are processed instantly, so you don’t have to worry about overdue bills.

How to Get Started with Vtpass

Getting started with Vtpass is a straightforward process:

1. Create an Account: Visit Vtpass and sign up for an account. You’ll need to provide your basic information, such as your name, email address, and phone number

2. Browse Available Services: Once you have an account, explore the wide range of services that Vtpass offers. You can choose from bill payment categories like electricity, water, cable TV, and more.

3. Enter Bill Details: Select the service you want to pay for and enter the required details, such as your customer ID or meter number.

4. Review and Confirm: Double-check all the information you’ve entered and confirm that everything is correct.

5. Make Payment: Choose your preferred payment method. Vtpass supports various payment options, including debit cards, internet banking, and Pay with Vtpass credit.

6. Receive Confirmation: After a successful payment, you’ll receive a confirmation message along with a receipt.

Tips for Using Vtpass Effectively

To ensure that you make the most of Vtpass and never miss a due date again, consider the following tips:

1. Set Up Reminders

Take advantage of the reminder feature on Vtpass. Set up reminders for all your due dates, and customize them to your preferences. You can receive reminders via email or SMS, whichever you find more convenient.

2. Plan Ahead

Don’t wait until the last minute to make your payments. As soon as you receive a reminder, plan your payments and complete them ahead of the due date to avoid any last-minute stress.

3. Use the Vtpass Wallet

Vtpass offers a wallet feature where you can preload funds. This is a great way to streamline your payments, as you don’t have to enter your payment details every time you make a transaction. Plus, you can earn rewards for using the wallet.

4. Keep Records

Always keep a record of your transactions. Vtpass provides receipts for all your payments, which you can save for future reference. This

is especially useful for tracking your expenses and ensuring that your payments are properly processed.

5. Stay Informed

Regularly check your email and mobile phone for Vtpass reminders and updates. Staying informed about your upcoming bills and transactions is crucial for managing your finances effectively.

Real-Life Scenario: How Vtpass Can Save the Day

To better understand the impact of Vtpass on everyday life, let’s explore a few real-life scenarios:

Scenario 1: The Forgetful Parent

Meet Sarah, a busy working mom with two children. Her life is a constant juggle between work, school runs, and household chores. In the midst of all this chaos, Sarah sometimes forgets to pay her electricity bill on time, leading to annoying power outages. With Vtpass’s automated reminders, Sarah can now set up notifications for her electricity bill due date. This ensures that she never forgets to pay her bill, and her family enjoys uninterrupted power supply.

Scenario 2: The Frequent Traveler

John is a frequent traveler who often forgets to renew his cable TV subscription. He’s on the road so often that managing bills becomes a daunting task. Using Vtpass, John can schedule reminders for his subscription renewal. Even when he’s away, he receives timely notifications and can complete his payments from anywhere in the world. This way, he never misses his favorite shows.

Conclusion

By using Vtpass, you can take control of your finances, stay organized, and never miss a due date again. Say goodbye to the hassle of bill management and embrace the convenience of Vtpass for a more stress-free and efficient life.

So, why not give Vtpass a try today and experience the benefits for yourself? Say goodbye to overdue bills and late fees – streamline your payment experience with Vtpass, and regain control of your financial life.