Third party car insurance is a compulsory policy required for all car owners in Nigeria and is backed by law.

Third party car insurance cover or liability cover is a policy which protects the car owner or driver of the vehicle against any legal liability, accidental liability, financial loss or property damage, medical expense cover in the event of an injury to or even death of any third party arising out of their vehicle.

Asides from being a mandatory requirement for using the road for drivers, below are other benefits of having third-party auto insurance:

Provides Legal Cover and Financial Assistance:

Third-party auto insurance covers the insured person’s legal liability in case of death or disability to any third party, and any loss or damage to a third party property.

Ensures Peace of Mind:

Third-party auto insurance brings peace of mind when dealing with any traumatic situation that hinges on financial payments. Hence, instead of worrying further about such unforeseen expenses, the focus is just on the immediate relief from stress and coping up with the incident.

Security:

Third-party auto insurance gives you confidence when you get into a road accident and also covers you against violent reactions in cases of accident/loss.

Easy Round the Clock Availability of Third Party Car Insurance:

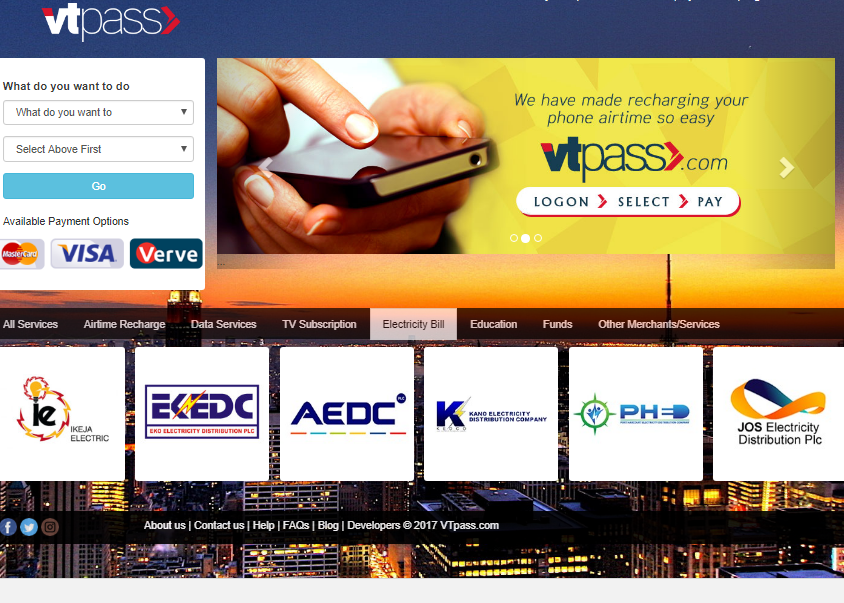

Unlike other insurance policies that are limited to only the offline method of renewal or application, VTpass third-party auto insurance is easily available online round-the-clock i.e 24/7, and 365 days a year from any location.

The shift of burden:

With third-party insurance, you do not need to worry over the third-party loss as the Insurer supports you in such instance.

Now that you understand why it is so important to invest in a third party car insurance, always remember that this is the best way to gain comprehensive coverage against losses that you might incur if your car gets damaged, stolen or causes injury, death, and damage to third-party or third party property.

How To Purchase Third-Party Auto Insurance Policy

Steps ;

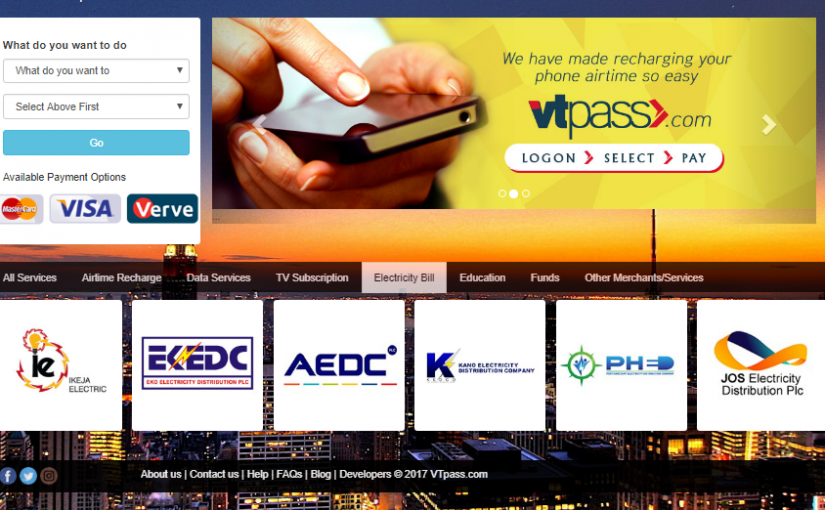

1) Visit vtpass.com

2) Select the Auto Insurance icon

3) Enter full information and payment details

4) Click Submit

What & How Can You Invoke The Third-Party Insurance Policy?

Anytime you get involved in any of the scenarios mentioned in the previous paragraphs (and covered in the insurance contract); all you need to do is file a claim. You can file a claim directly via the Insurance Company or the agent that underwrote the insurance policy for you. Make sure you have clear photo evidence, and receipts (in case you paid for part or the full claims already).