Have you ever felt helpless as you looked at your electricity meter, not knowing how to purchase tokens or keep the lights on? This blog post addresses important topics with your electrical token and offers an innovative solution: VTpass is your one-stop store for easy and quick token acquisition.

What is electricity token and how can you get it?

To top off your power meter, an electricity token functions similarly to a pre-paid code. When you use electricity, the meter subtracts units from the amount you paid for.

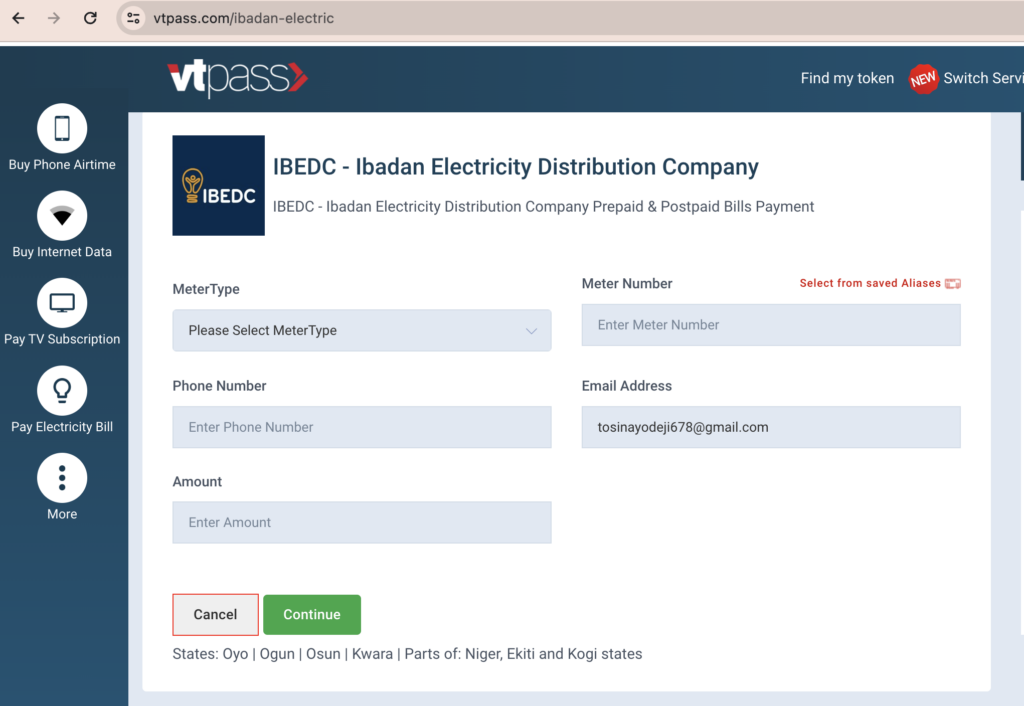

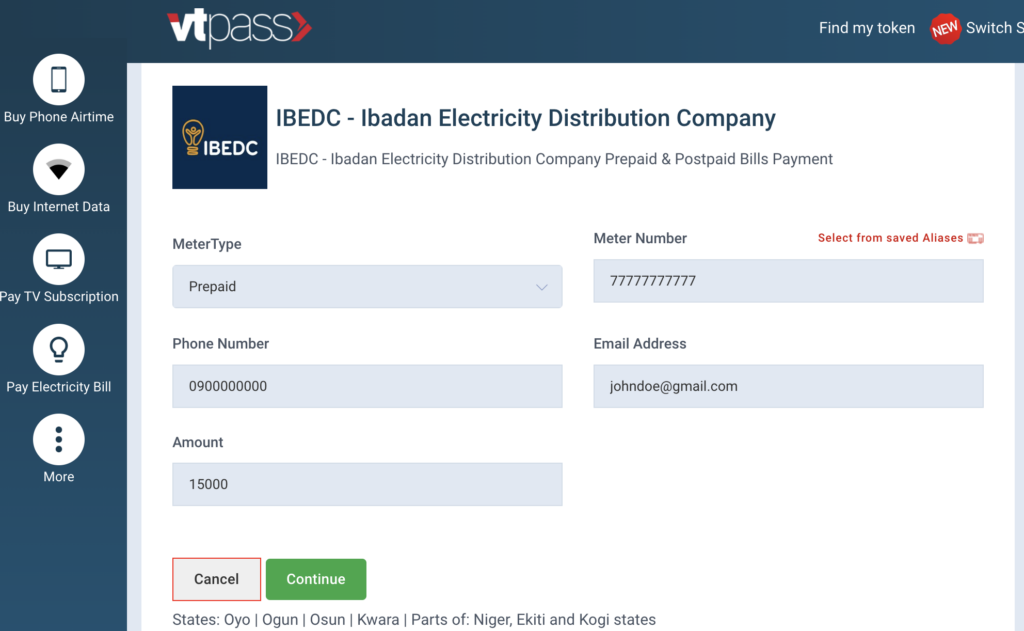

1. Locate Your Meter Number Here:

Your electricity meter’s front has a unique number that serves as your meter number. It is essential for making the right token purchase and guaranteeing that your home is connected to electricity.

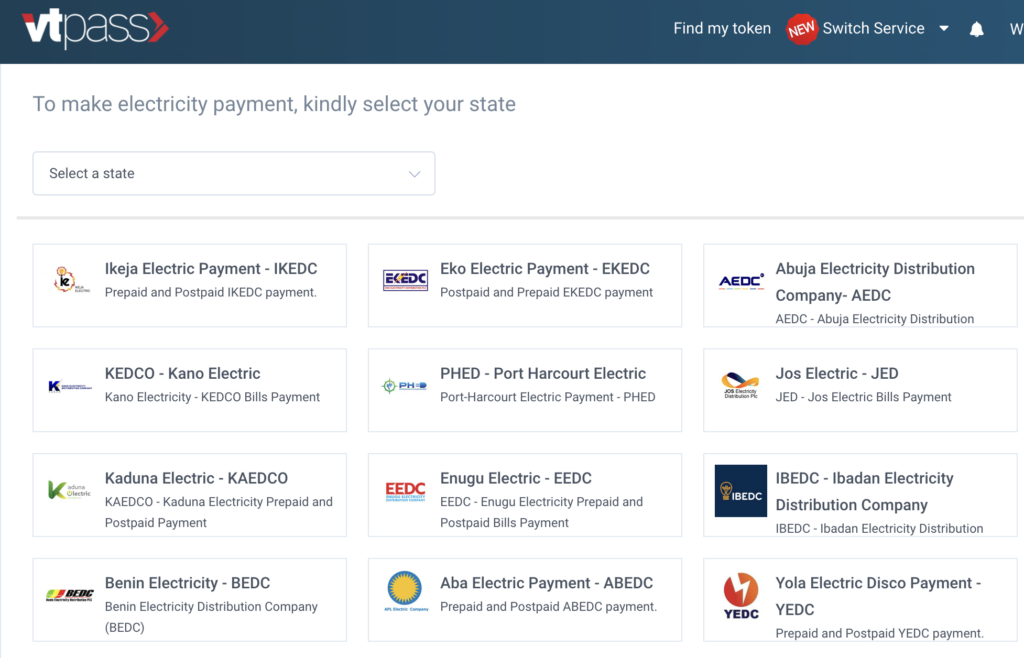

2. Various Tokens for Various Distribution Companies (Discos):

Nigeria is home to a number of different power distribution businesses. Your chosen Disco has to be compatible with the token you buy. Worry not—VTpass will guide you through this during the buying process.

3. Do You Have Any More Tokens? Not a problem!

Just think of how terrifying it would be to have a power outage on your preferred movie night because you neglected to purchase a token! With the help of VTpass, you may buy electricity tokens whenever and wherever you want, guaranteeing continuous power supply (and endless movie marathons!).

4. VTpass Simplifies the Process of Obtaining Tokens:

The days of standing in line are long gone. With VTpass, you can easily get your token. Here is how:

1. Enter your meter number and disco with ease.

2. Decide how many units of power you want.

3. Make safe payments with a variety of payment options.

4. Get your token right away using the VTpass app or website.

VTpass allows you to track your electricity consumption history, helping you manage your usage and budget effectively.

So, ditch the stress and embrace the convenience! Download the VTpass app or visit our website today. No more deciphering electricity tokens—just seamless power management at your fingertips!