Today, I’ll be walking you through easy ways to pay your GOtv bills. Truth be told, having to pay bills is stressful enough. So much so that I believe the actual process of making payment should be easy. You agree right? Exactly! That’s why I have collated 5 easy ways you can use to pay your GOtv bills.

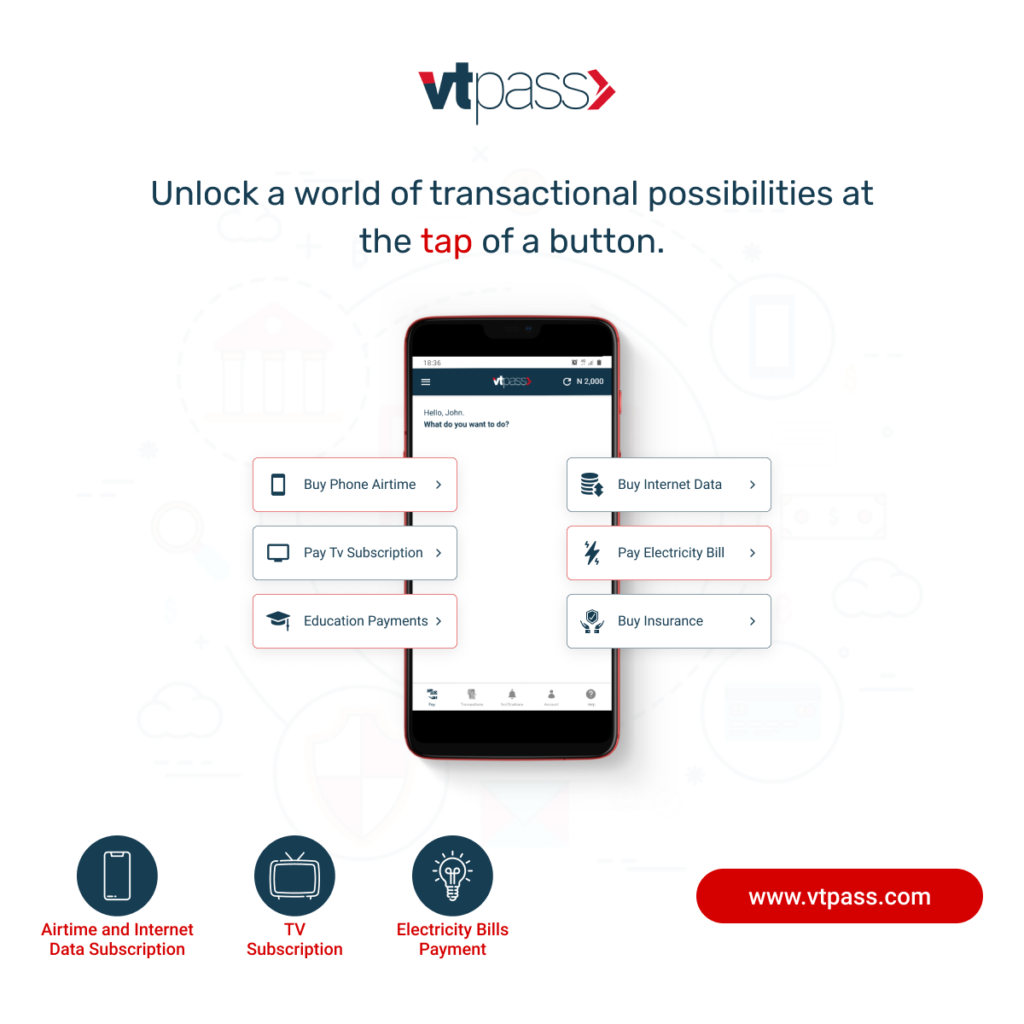

Firstly, let’s talk about the platform. VTpass comes highly recommended. Why? VTpass is an online bills payment service that brings with it years of credibility. Firstly, your payments are processed at superfast speed. Secondly, you get value instantly. Thirdly, they have tools built into the system to help you resolve issue yourself immediately. Similarly, they have an effective support unit should you need additional help or guidance.

I have listed 5 easy ways you can use to pay GOtv bills using VTpass below so you can choose whichever option you are most comfortable with. Irrespective of the method you choose, you will need to first log on to vtpass.com/gotv and input your IUC number. Our system will intelligently fetch the details of the decoder and display it to you.

Subsequently, you will either select “Renew current bouquet” if you wish to stay on your current bouquet or “Change Bouquet” if you desire to upgrade or downgrade to another bouquet of your choice, after which you fill other required fields and then proceed to payment. At this point, you can:

Options To Make Easy Payment

- Pay Via USSD – If you are a *something# kind of person, this is right up your sleeve. Simply click on “pay with bank transfer” and select the USSD option. Choose your bank and make the transfer by dialling the unique USSD code generated on your screen. All done!

- Pay Via Debit Card – Select the “pay with card” option. Provide your card details and complete your payment and you’re all set!

- Pay Using Bank Transfer – Click on “pay with bank transfer”. Subsequently, account details for the transfer to be made will be displayed on your screen. You can now make the transfer to complete your payment.

- Pay Using VTpass Wallet – The VTpass wallet is a virtual store you can keep your funds in to make payments with. It functions like a virtual personal bank account. Once you fund your wallet, you can easily make payments on VTpass. When you are asked to select payment method, simply tap on “pay with vtpass wallet” to complete your payment.

- Pay Via QR Code – Proceed to payment and click on “pay with bank transfer.” Click on “Visa QR” and a unique QR code will be generated for you to scan. Next, open your mobile banking app, click on Visa QR Payments and scan the merchant QR code. Enter amount if prompted and complete payment.

In conclusion, irrespective of the payment option you choose, your payment will be processed instantaneously and you get your GOtv reconnected immediately. Now that’s payment convenience!